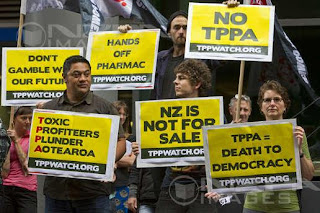

Multiple countries are rejecting investor state dispute settlement clauses in free trade agreements

by Janet Eaton

In particular this provision has emerged as a point of major contention in the Trans-Pacific Partnership (TPP) negotiations, with Julia Gillard's Australian government announcing last April that they would reject investor-state arbitration in all trade agreements. It seems that her government was not only concerned about the loss of public policy sovereignty but was also taking seriously the advice of the Australian Productivity Commission which concluded there were "few clear benefits, and several worrying risks, associated with such provisions."

Following on the heels of Australia, Korea appeared poised to go the same route with polls showing the opposition, which rejected ISD, favoured to win the upcoming election; however, in the election held last week, the governing Conservatives managed to hold on to a slender majority so the jury is still out as regards South Korea. However one clue might be found in a recent April 6th claim by India that it plans to abolish the investor-state dispute system and renegotiate FTAs with South Korea, Singapore, and other countries. According to the English language newspaper, Indian Express, New Delhi´s decision to abandon the ISD system is based on its first-hand experience with the potential threat foreign companies pose to public policy on the grounds of investment agreement violations.

Other countries that have concerns with, are opposed to, or have rejected, ISD, include the South African government which is re-examining the ISD system after a policy of affirmative action for blacks, aimed at reducing economic disparities between white and black people, was targeted in 2007 by a multinational corporation; the Brazilian parliament which has refused to ratify a number of investment agreements on the grounds that they infringe on legislative sovereignty and Ecuador and Bolivia that have pulled out of the International Center for Settlement of Investment Disputes convention.

Meanwhile in the US and Canada, both President Obama and Prime Minister Harper are pushing Investor State Dispute settlement in their frenzy to initiate free trade deals in every corner of the world. In the case of Obama this is in spite of his presidential campaign promises to review NAFTA Ch 11 [investor state] and other harmful aspects of free trade agreements in general and in spite of over 100 members of Congress and many progressive NGOs expressing support for the TRADE [Trade Reform, Accountability, Development and Employment] Act introduced by Representative Michael Michaud [D-Maine] and Sen. Sherrod Brown (D-Ohio).

In the case of Mr. Harper, he ignores calls from civil society, NGOs, institutes, activists and three opposition parties to renegotiate NAFTA Ch 11 while belittling anyone who tries to make the case. . [6]

Hopefully this momentum to reject the ISD system will eventually be powerful enough to influence the Harper government because in the words of a statement of concern initiatied by Canadian academics with expertise relating to investment law, arbitration, and regulation:

"We have a shared concern for the harm done to the public welfare by the international investment regime, as currently structured, especially its hampering of the ability of governments to act for their people in response to the concerns of human development and environmental sustainability."

Photo: Foreign Policy In Focus

No comments:

Post a Comment